Compare Car Insurance Online

If you are looking to compare car insurance then our simple guide to car insurance can help you. You should compare your car insurance every time it is up for renewal as often, companies will sneak on a little extra and you’ll slowly see your car insurance premiums creep up through a ‘loyalty tax’ that car insurance providers charge when you’re too busy to compare car insurance providers and switch plans.

This Money Compare guide to car insurance from NZ Compare will help you save money on your car insurance when you compare features and benefits from some of the main NZ car insurance providers.

3rd Party Car Insurance Comprehensive Car Insurance

3rd party, fire & theft COMPARE ALL CAR INSURANCE

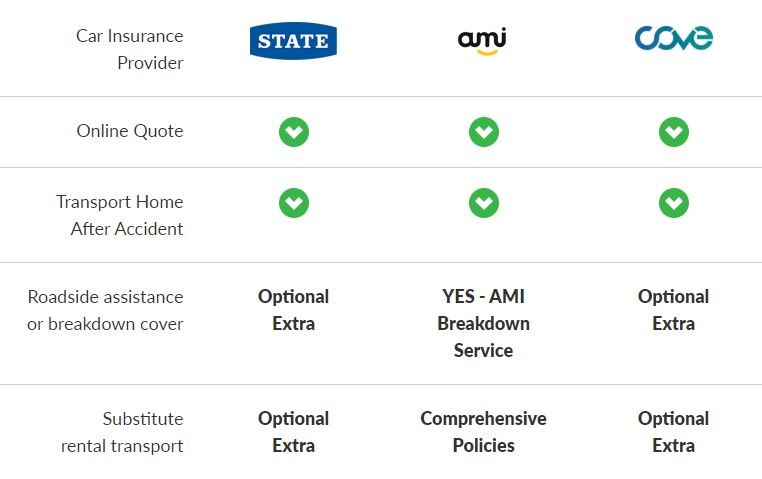

Compare Car Insurance online with our 3 featured car insurance providers

Switching car insurance provider can save you a decent amount of money - our top three insurers offered good deals year-round to attract new customers including online sign up bonus and first month premium for free.

Types of Car Insurance

Before you compare car insurers you should think about the type of car insurance you need.

When we began comparing the different features available from some of the main car insurance providers we looked at car insurance policies from AMI, AA Insurance, Cove, State Insurance and Tower Insurance.

In our simple survey, policy features varied quite significantly so it is certainly worthwhile to compare car insurance features and what you need before you progress to comparing car insurance quotes and policies. Prices for car insurance do vary quite significantly as every combination of car and driver(s) is unique.

As a simple guide to comparing car insurance features in different policies, comprehensive car insurance is almost always more expensive than third party or third party, fire and theft. A comprehensive policy is best and usually more popular for vehicles which are worth more than $2,000. With that in mind, even if your car is worth less than $2,000 if you were going to be unable to replace a car in the event of an accident a comprehensive policy is likely best.

Across New Zealand the prices will also vary and we have found that Auckland car insurance prices can cost almost two times the price of insurance for those in the countryside or more rural regions. It makes sense. The cities have more cars on the road and more accidents and crime so you’ll obviously be paying more for insuring your car in these regions or areas.

Market Value or Agreed Value

A common policy from car insurers is for the insurance to cover ‘market value’. As your car ages its market value will drop and so the amount of money you will receive for your vehicle in the event of an accident will be less. As a way to avoid the 'market value' trap you can agre a value between yourself and the insurer. This agreed value might put a little bit on your premium but it means you’ll know what you’ll be paid out in the event that you have to claim. With a ‘market value’ car insurance policy your car insurance payout will decrease as your car loses value as it ages. So, for example, insuring your car today it may be worth $20,000 so you'll be insured for market value and if it was a write off you would be paid that $20,000. However, in two or three years’ time the value of the vehicle is likely to have dropped and so your payout may only be $15,000 even though the insurer is unlikely to reduce your car insurance premiums year by tear as the value drops.

This is a prime example of the importance of comparing car insurance plans and providers in New Zealand.

How to get cheap car insurance in NZ

There are a couple of ways that you can directly impact how much you pay for your car insurance.

First off, age. When you’re older, as a general rule you will pay less insurance for you car. This is because young driver insurance is more expensive as young drivers have less driving experience and recently qualified drivers carry the highest risk of an accident.

One sure fire way to get cheaper car insurance is to pay for your car insurance annually instead of monthly. Car insurance is usually always cheaper when you pay this way, sometimes by as much as 15% over the course of the year.

The best way to get cheaper car insurance? Compare car insurance providers. You can compare Car Insurance policies and quotes with Money Compare. Click here to compare car insurance products.. Getting a quote online from these providers is quick and easy, you just need to check the policy features, click through and complete the online quotes. It takes just 5 minutes per provider and you could save big on your car insurance.

Some of the demographics and variables that set the price of your car insurance can’t change unfortunately and insurance companies consider a wide range of elements when they decide how much it will cost for you to insure your vehicle. Some of these include:

- Age of driver

- Gender of driver

- Driving history – how long you have held your licence and number of accidents

- Location in New Zealand

- If the car is used for work or solely personal

- Car make, model and year

- How and where you store your vehicle

Put simply, the greater the risk to the insurer the higher your car insurance premium will be. For example, a 45 year old female in Hamilton with 25 years driving experience and no accidents in her history will pay significantly less than an 18 year old in Auckland who has already had one small crash. It makes sense right? So it pays to compare car insurance providers to get the cheapest car insurance and the best insurance plan for your needs.

How much Car Insurance Excess should I pay?

This depends on your circumstances. First off, what is car insurance excess?

Well an excess is the money that you, as the insured, need to pay when you make an insurance claim. Excess is a fixed dollar amount and as a general rule, the higher the excess amount the cheaper your car insurance will be. So, it pays to compare car insurance excess when you are comparing your total insurance package. What looks like a cheaper policy may be cheaper because the excess is double, for example.

You will generally need to pay the excess before you receive any insurance pay-out, although this is often deducted from the overall pay-out amount.

Do I need 'Third party', 'Third party, fire and theft' or 'Comprehensive' Car Insurance?

This depends on your needs, but to make a fully informed choice you first of all need to understand the difference between these different types of car insurance policies.

A. Comprehensive Car Insurance

Comprehensive car insurance does what it says on the tin and offers the most comprehensive cover. This type of car insurance policy is the most expensive but also has the most features. A comprehensive car insurance policy will pay out on pretty much everything relating to damage to your car or others if you are at fault. A comprehensive car insurance policy will usually cover accidental damage, windscreen issues and even certain car faults.

Compare Comprehensive Insurance

B. Third party Car Insurance

The cheapest type of car insurance. Which means it also covers the least. Third party is limited to protecting the people and things you share the road with – hence third party. A third party car insurance policy will pay out to people affected by an accident you are responsible for. However, it will not pay out for your own car or damage done to your own property or yourself. Third party car insurance has its place and is most suitable for drivers with a cheap car – anything less than, say, $2000 in value.

Compare Third Party Insurance

C. Third party, fire and theft Car Insurance

Similar to third party car insurance, third party, fire and theft car insurance increases the insurance cover to include if your car catches fire or is stolen. If your car is of relatively low value but you would be inconvenienced if it was stolen or you live in a high car crime area this may be a suitable car insurance policy type.

Compare 3rd Party, Fire & Theft

Compare Car Insurance Online

Car insurance, like most fixed and commodity bills, is usually considerably cheaper if you compare before you buy. Use Money Compare to help you compare car insurance providers and car insurance policies. Make sure you insure your vehicle for the right value and the right features as your car is probably a vital tool to get around day-to-day. Protecting your car with a suitable car insurance policy can help protect you if the unforeseen happens and your car is stolen, damaged or you are involved in an accident.

Compare comprehensive insurance policies, third-party insurance policies and third-party, fire and theft policies side-by-side in one place. Compare New Zealand’s main providers to find the best insurance rates and protect your car for less.

As with all types of insurance, you should consider the type of insurance that suits you, and how much you want to pay for insurance... then compare the price and save.