Buying a home is an exciting time. It is the start of creating a place that you can call your very own, and a foundation from which memories can flourish. But the home buying process can be a little intimidating, and there are a lot of steps to make and hurdles to overcome.

Having a deposit ready is one of them.

How Much Do You Need For a Deposit?

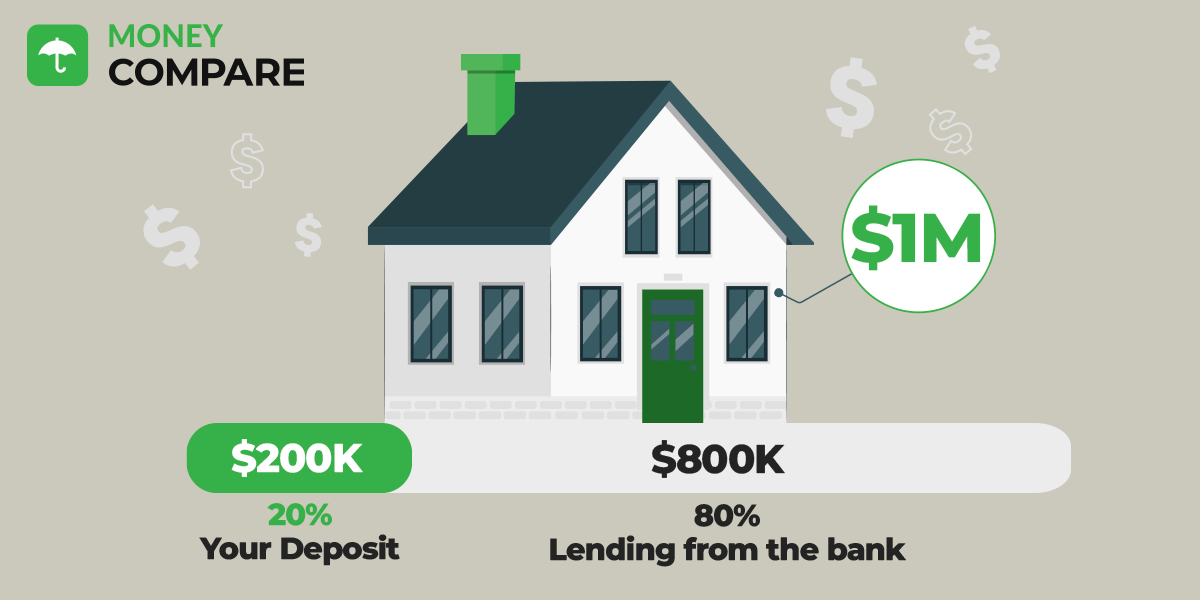

When you buy a home, you need to put down a deposit. Your lenders, like your bank, will then cover the rest of the purchase cost, and you will then pay that money back to them over time in the form of a mortgage repayment, which includes interest on your loan (interest rates) that goes to the bank and principle which is the part of the mortgage repayment – this will reduce your overall loan amount. This is why locking in low interest rates is so key, so most of your repayment is going on the actual loan vs interest.

Generally, the amount of money you will need for a deposit will depend on whether you are buying the property for investment purposes or to live in yourself. This is because the Loan to Value Ratio restrictions are tougher for investors than other types of borrowers. For an investment property, the bank will typically expect a much larger deposit of 30%+.

Most banks and non-bank lenders, such as Avanti Finance, will require you to have either a 20% deposit for a pre-approval, or 10% in the case of an existing offer. In some instances, banks will allow a 10% deposit if you are an existing customer. However, if you seek an investment property, the deposit will need to be 35%.

Rule of thumb for first time buyers, the deposit will need to be 20% of the home’s value. So, if the home is worth $500,000, you would most likely need a deposit of $100,000.

What Lenders Must Know

Lenders want to make sure that you'll be able to pay your loan back to them, consistently and without disruption. They will ensure this by checking your income, including your spending habits, credit history, and whether you pay your rent and bills on time. Lenders will also check how much deposit you have available to you. They will typically ask for the last 6 months worth of payslips and bank statements. Be sure to be ready for the fine tooth comb that is the approval system.

Your Deposit and Loan Approval Can Change Depending on the Property

Typically, banks will want to review each property you are looking to make an offer on, to ensure it isn’t a risk for them, or you! This may mean that the amount you are pre-approved for and therefore the deposit you need can change per property. Always ensure you check each time.

How Can You Save For a Deposit?

Assess your budget: Figure out how much you can save comfortably weekly or monthly based on your income and expenses.

Transfer that money into a higher-interest savings account: These accounts are great because you can earn interest on top of your savings. It’s a great way to have your money work for you!

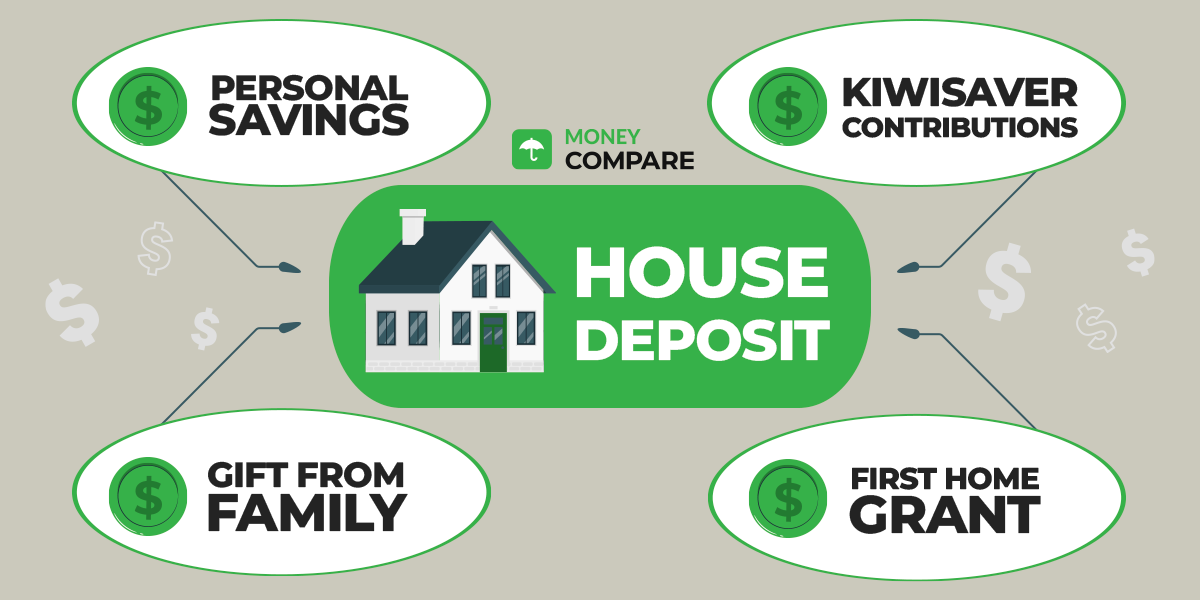

Cut down on spending: If you can reduce your weekly takeout treat to monthly, you will save a great deal of money over time, and that money can be put towards your savings or go into your Kiwisaver. Do you really need to buy into the latest social media trend? Establish a sense of discipline for long term benefits. You will soon be a homeowner and your hard work and sacrifice will all be worth it!

Increase your Kiwisaver contribution: Your employer will also match your contribution. This behind-the-scenes growth is an amazing way to meet your deposit goals, along with your other savings tactics.

Compare Your Bills: Take advantage of NZ Compare’s array of powerful tools. Broadband Compare, Mobile Compare, and Power Compare help you compare providers and plans available to you so that you can make the most informed choice about your utilities and find a better deal. By finding a better deal, with NZ Compare’s comparison websites, you will save money month-to-month. You can save over $300 a year by making a switch to another provider or plan. Put those savings towards your deposit!

Need Help? Our experts offer FREE advice

Here at Money Compare we have experts on hand to help with any home loan or mortgage query - simply request a free call back by clicking the button below and a fully qualified mortgage adviser will be in touch.